When the ABS released the previous installment of its Household Spending Indicator (which has replaced its retail sales index) last month, the data was further fuel for the narrative that the next move in interest rates would be up.

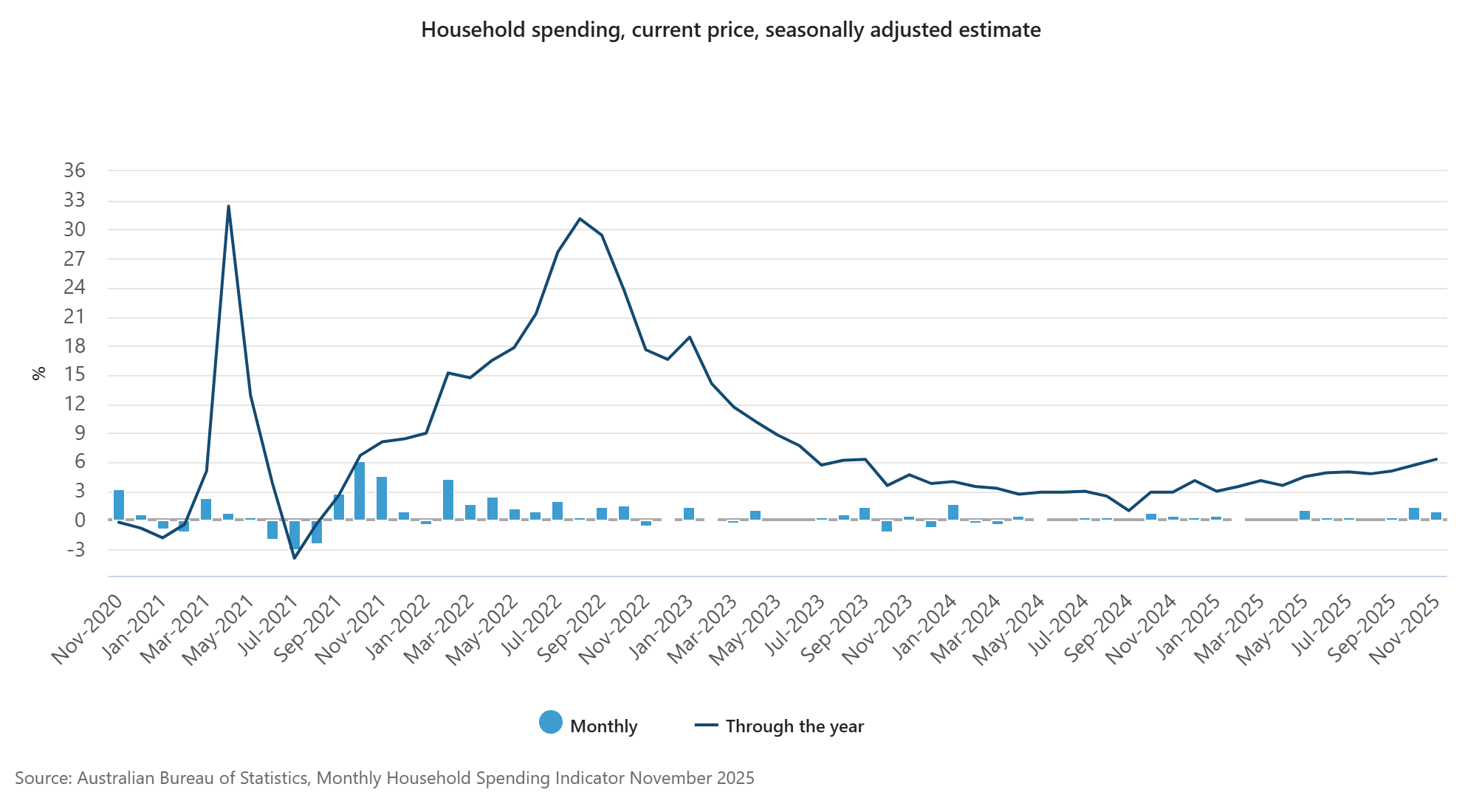

The data revealed that October held the highest month on month growth in nominal household spending since January 2024, up by 1.6%, with the rolling annual rate of growth accelerating to 5.6%, the highest level since September 2023.

Today’s data has only reinforced that expectation further, with household spending up 1.0% for the month of November and up by 6.3% on a rolling annual basis, the equal strongest reading since September 2023.

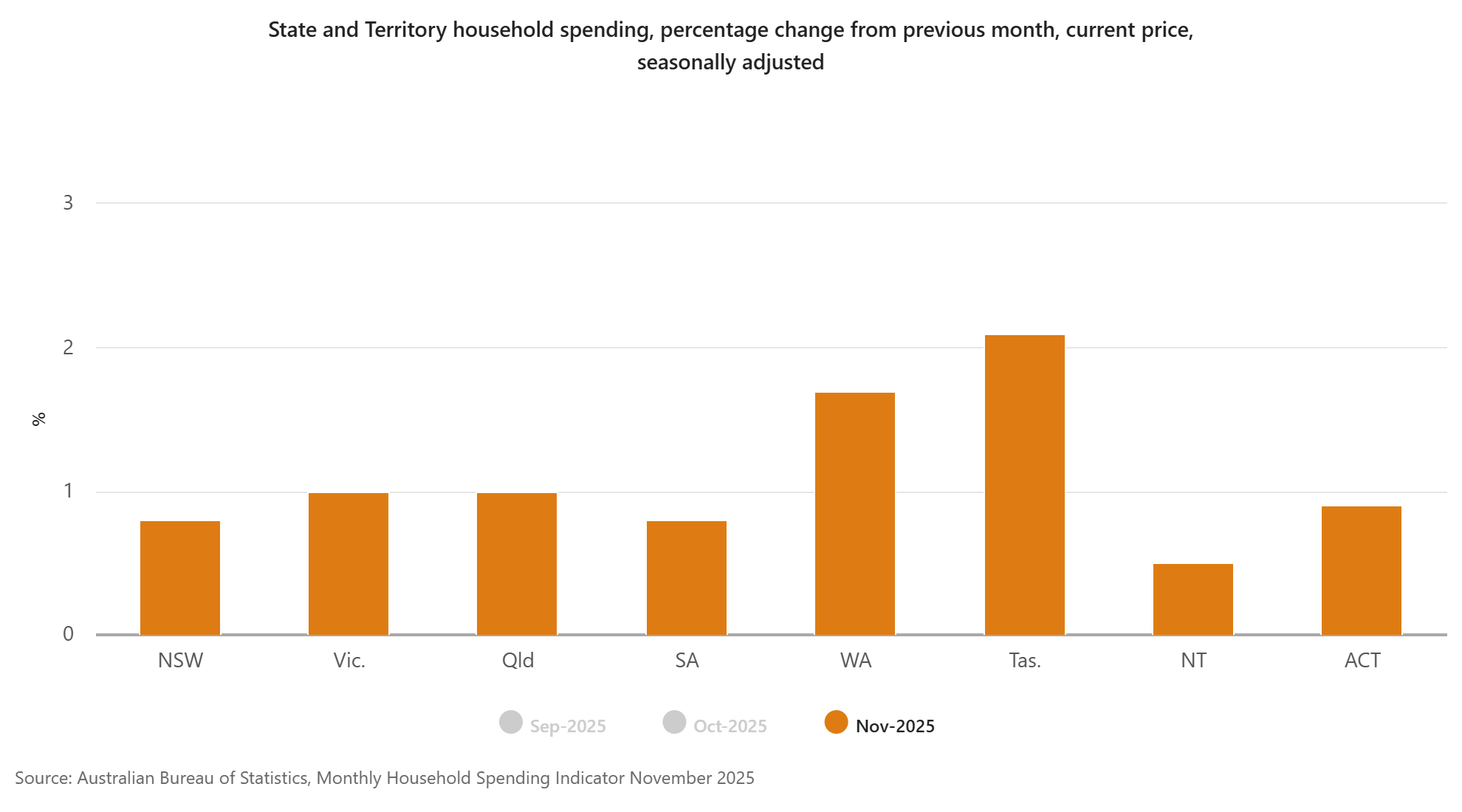

Strength in spending was broad based, with even some of the worst performing states such as New South Wales and South Australia seeing robust growth of 0.8% for the month.

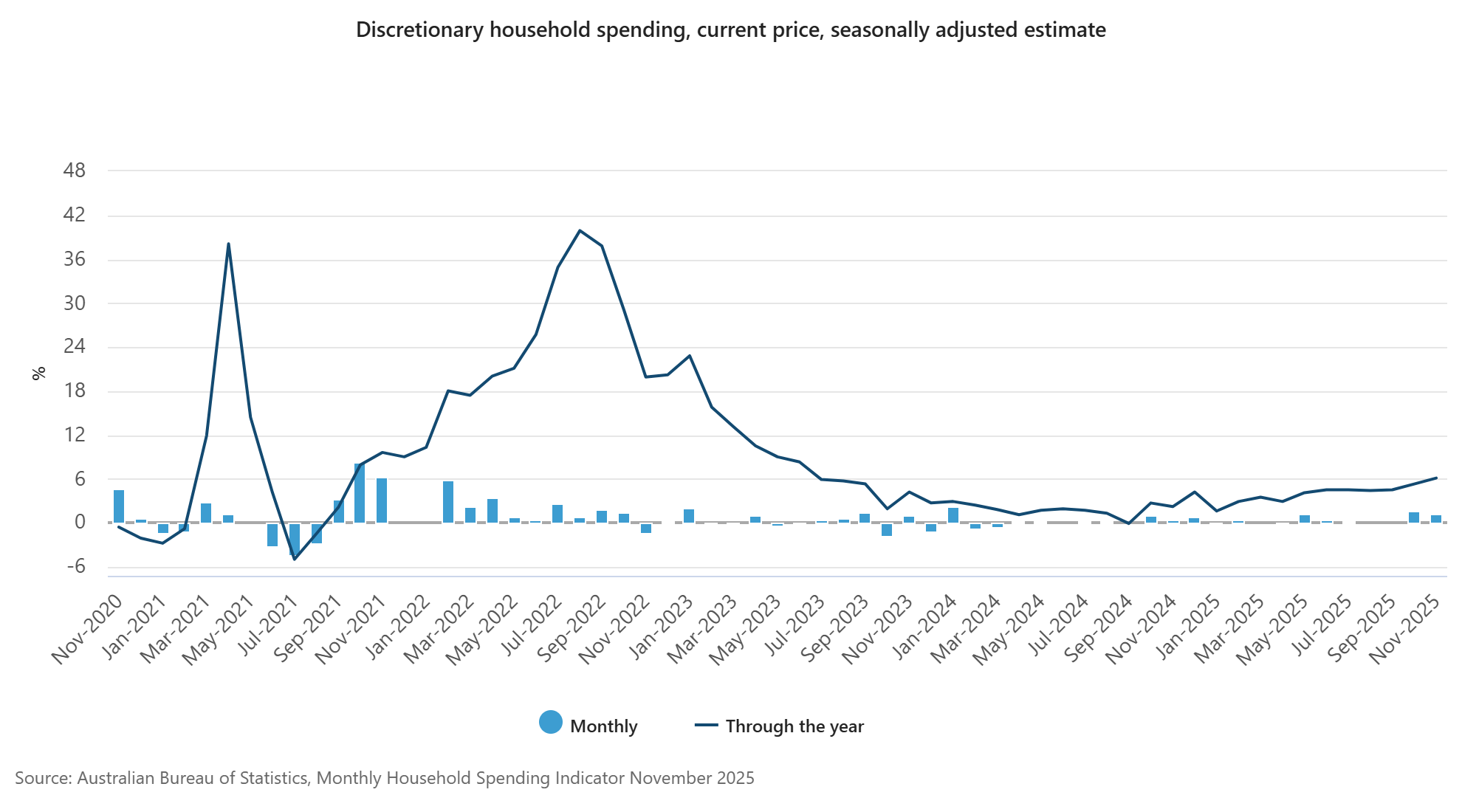

It was also not just a case of a rise in non-discretionary spending as a result of rising costs.

Discretionary spending is up by 6.1% year on year, it’s strongest performance since June 2023.

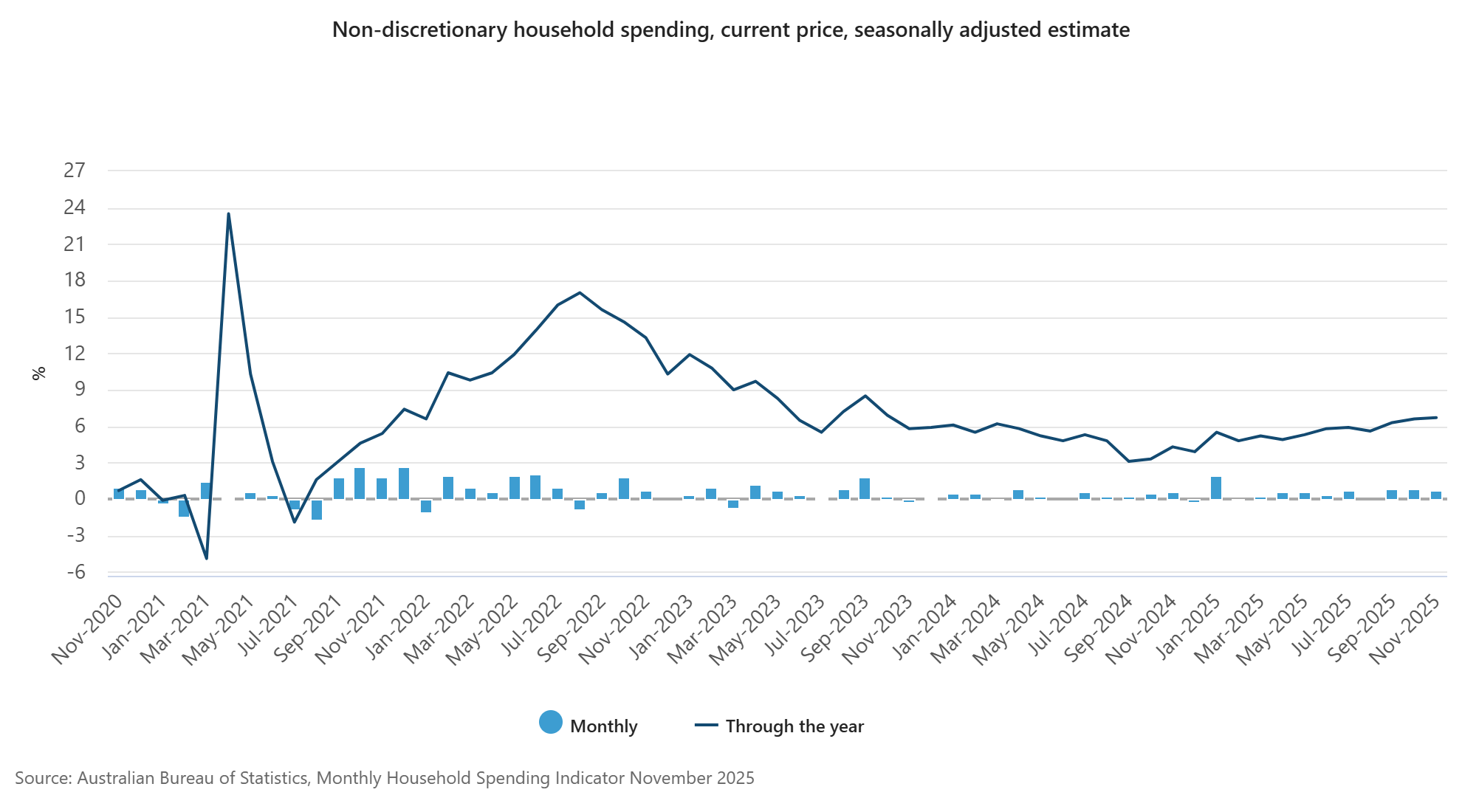

Meanwhile, non-discretionary spending is up by 6.7% in the last 12 months of data it’s highest reading since September 2023.

The Takeaway

It is entirely possible that there are seasonality issues and we will see a significant give back of some of this growth in December’s data, but how that plays out in reality remains to be seen.

From the perspective of a broad overview, this is a strong result and the latest of in a line of recent robust performances.

In a vacuum is likely to heap further pressure on the RBA to raise rates in the coming months.

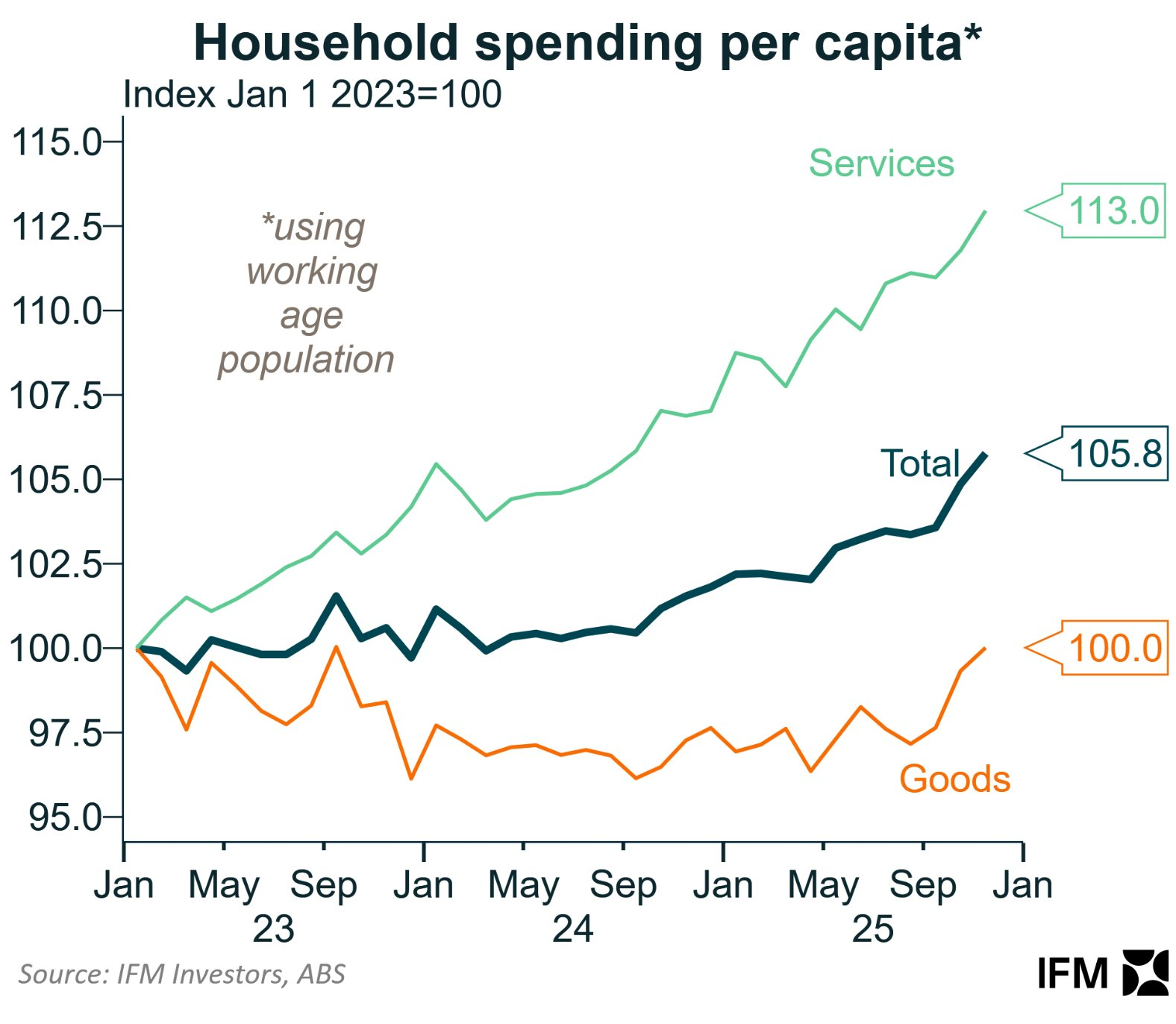

However, when the results are looked at through the lens of per capita spending, it reveals that nominal per capita spending has risen by just 5.8% cumulatively since January 2023.

Source: Alex Joiner IFM Investors

All in all, the nation’s consumer economy remains one that is entirely reliant on growth in the consumer base rather than growth in consumption per capita, with inflation adjusted spending going more or less no where.

That is certainly an unpleasant position for the nation’s households to find themselves in, but given the current rate of population growth, it remains a set of circumstances where rate rises are indeed a very real possibility.