Asian share markets are quite mixed as we go into the final session of the trading week with local shares outperforming. The USD remains firm due to safe haven bids except against Yen while the oil price has been beaten back slightly. The Australian dollar is failing to get back above the 67 cent level.

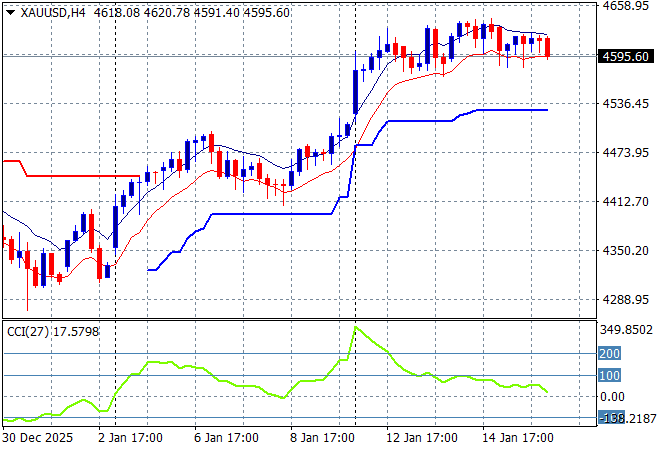

Oil markets are seeing a small reversal with Brent crude pulled back to the $63USD per barrel level while gold has failed to hold above the $4600USD per ounce level with a minor rollver:

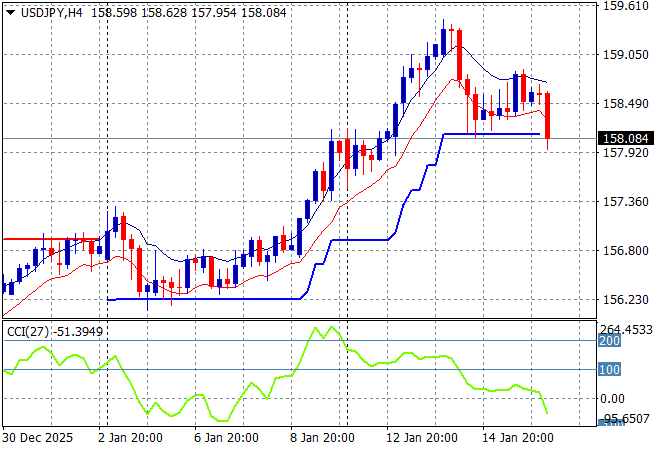

Mainland Chinese share markets are going nowhere in the afternoon session with the Shanghai Composite down just 0.1% while the Hang Seng Index is also dead flat just below the 27000 point level. Japanese stock markets are in mild retreat with the Nikkei 225 down nearly 0.4% to stay below the 54000 point level while Yen is firming for once, with the USDPY pair back down to the mid 158 level:

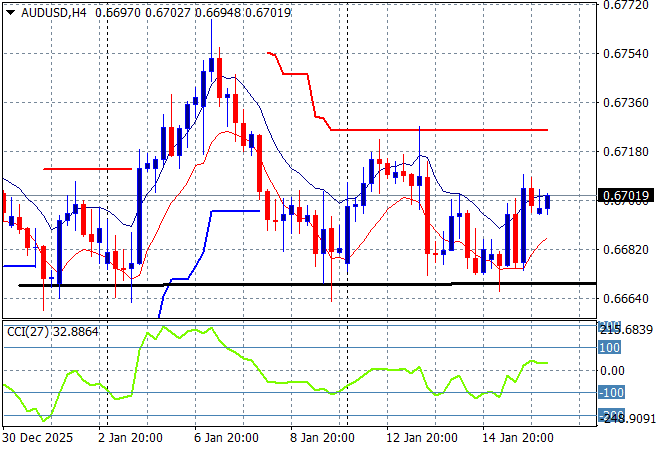

Australian stocks are again the best performers in the region with the ASX200 lifting more than 0.5% to 8906 points while the Australian dollar is trying to bounce back as it faces short term resistance at the 67 cent level and looks anchored at support just below:

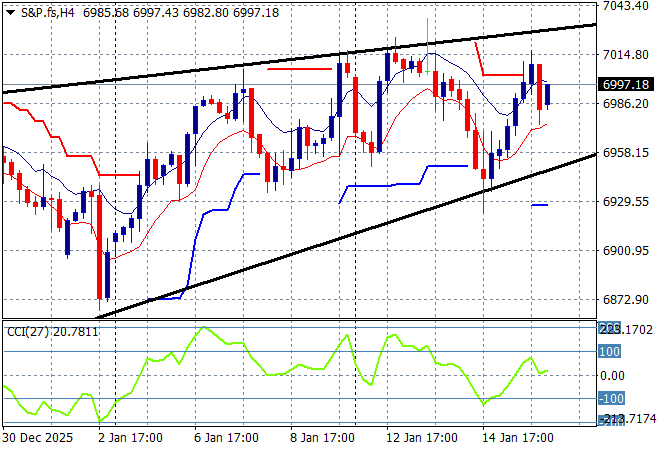

S&P futures are trying to make headway with the S&P500 four hourly chart still unable to get up towards the 7000 point level and potentially rolling over here as the rising wedge closes in:

The economic calendar ends the week quietly with some US manufacturing data but we also get a slew of official Chinese data over the weekend to watch out for.