All things Australian dollar are struggling a little this afternoon. DXY is firm.

AUD sideways.

CNY is still a thermal.

But the metals complex is off.

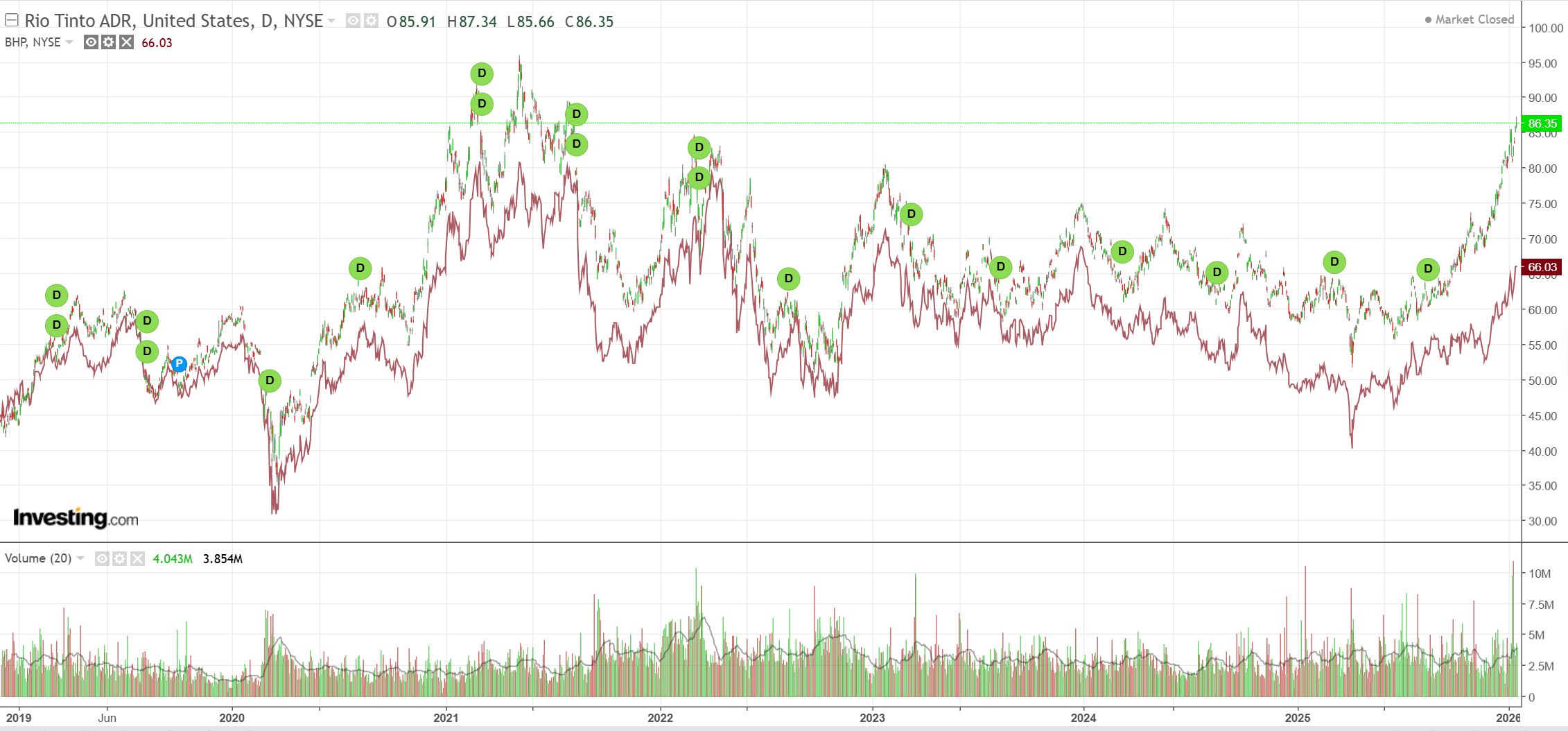

And miners.

And miners.

Plus EM.

Still no joy for junk.

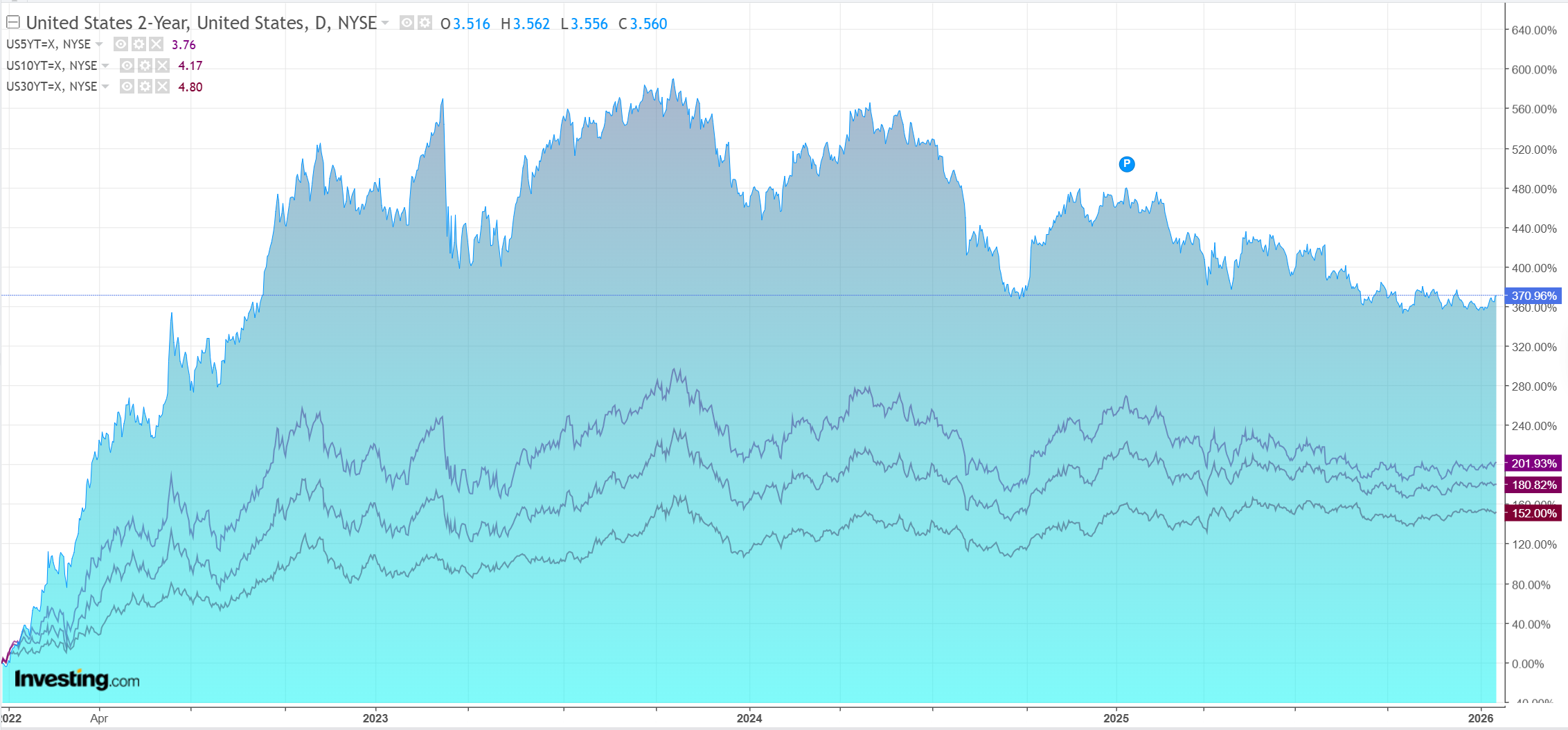

Treasuries are flatlined.

Stocks in a grind.

Chinese regulators can be quite heavy-handed at times.

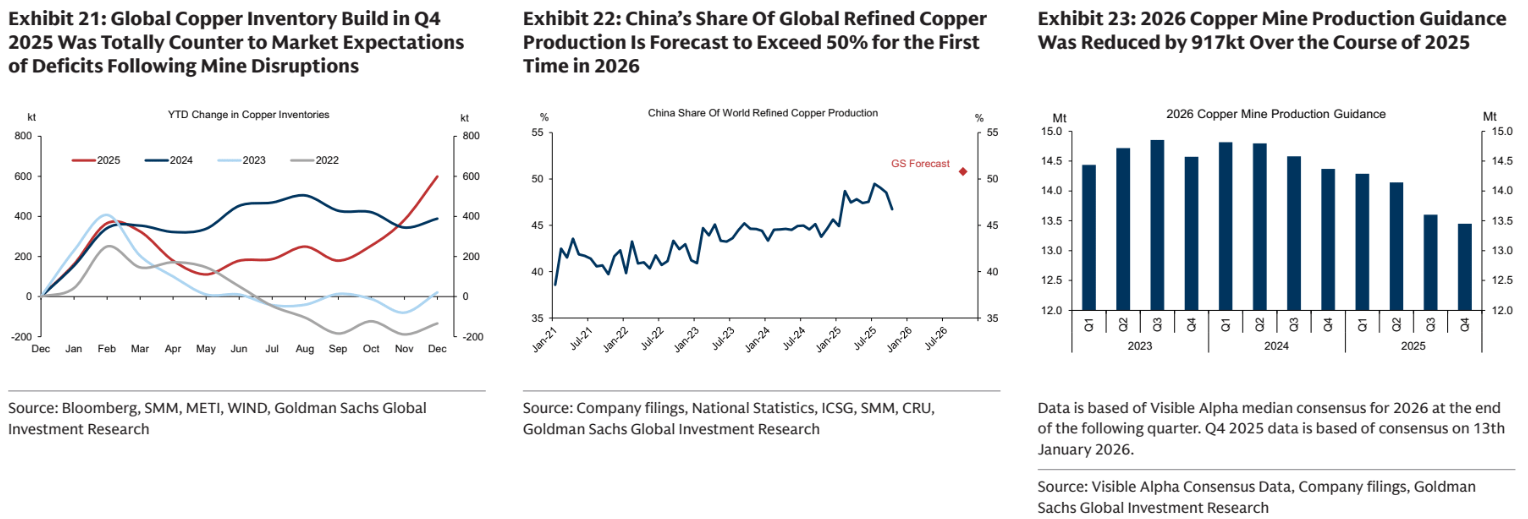

Metals fell at the end of a dramatic week, as China clamped down on high-frequency trading in a move that came after frenzied activity in mainland futures that helped to fuel global price gains.

Regulators have ordered bourses including the Shanghai Futures Exchange — the main metals platform — to remove servers operated by high-frequency traders from their data centers, according to people familiar with the matter.

China has been leaning against the stock frenzy all week. This also applies to the overheated metals market.

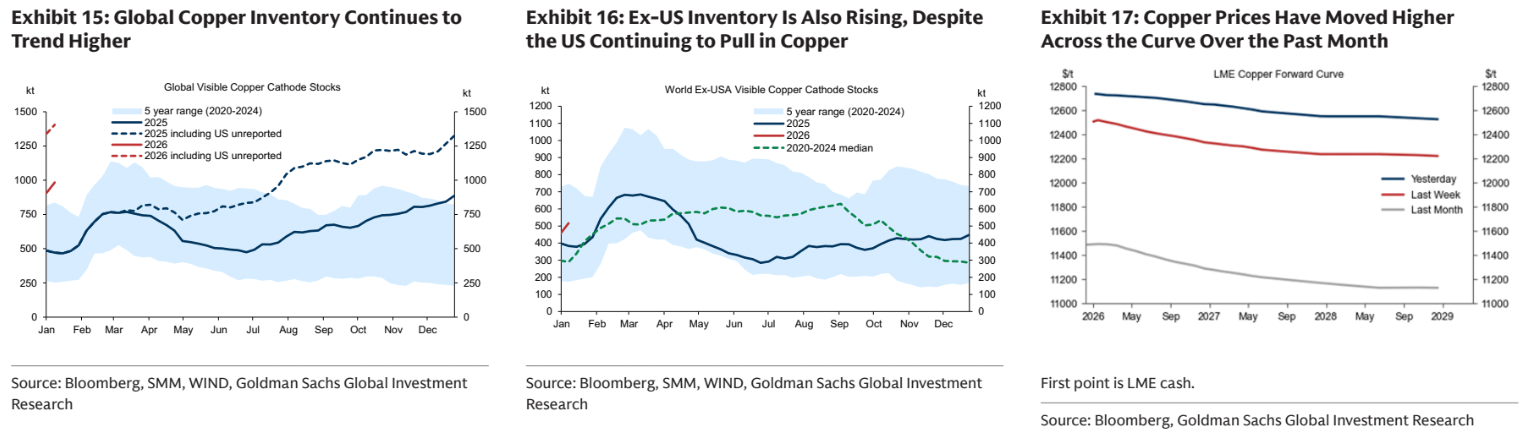

Copper is a good example. It is at an all-time high but is clearly being driven by hot money flows as inventories surge.

While the real economy demand slumps.

This is dramatically outpacing any moves in the USD, market balance, or economic prospects.

I’d argue it’s tied to a vague concern about resource nationalism associated with anarcho-imperialism, but, frankly, most of these metals are simply going up because they are going up.

China tends to approach these market bubbles with concerted campaigns, so expect more servers and carpets to be pulled out from under the rally in due course.

It’s a new headwind for the AUD.