Are LNG imports worthwhile given the approaching global glut?

Labor’s domestic gas reservation scheme has delayed talks on LNG imports into the country’s southeast by at least six months, but has not eliminated the need to bring in gas, according to aspiring suppliers.

They say the scheme will largely create an increase in available gas in Queensland, meaning it is of limited use in the southern states because the pipeline capacity south is already full on peak demand days.

Why would it increase gas production in QLD if it only applies to new projects? Existing projects will simply lift output to offset the reserve and keep exports high.

Because QLD is coal seam gas, is new drilling considered a new project? I hope so, but I doubt it!

Furthermore, APA has proposed expanding the capacity of southbound gas pipelines. It has completed two of five stages. The final three will require customer commitment and approvals, which, in turn, will hang on effective gas reservation.

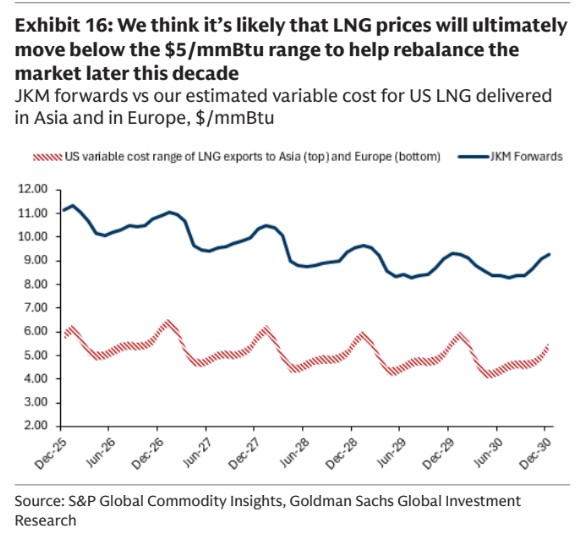

LNG import terminals could be useful during the forthcoming years of global glut. They will benchmark local prices to Asian spot prices plus the regasification toll.

That will deliver prices at $9-10Gj.

But this means we’ll be importing gas at prices above export netback, even when existing mechanisms like the ADGSM can be used to push prices below netback.

The difference will be $2-3Gj so it is not to be sneezed at.

However, we must first examine the gas reserve policy, as it initially appears unlikely to generate a significant domestic surplus at all.